georgia property tax exemption nonprofit

The measure would have provided that property owned by nonprofit organizations. There are limited tax exemptions from Georgia sales and use tax for.

How To Get A Sales Tax Exemption Certificate In Arkansas Startingyourbusiness Com

AND 2 Charity must not use the property to produce income subject to an exception discussed below 25.

. Referendum B provided that an existing tax exemption for nonprofit housing for the mentally disabled could be applied to housing constructed or renovated through financing from businesses. Property Tax Returns and Payment. The additional sum is determined according.

Alternative to tax deferral authorized by Code Section 48-5-72. Property Taxes in Georgia. This article describes some of the exemptions that may apply to nonprofit organizations.

D Property which is held by a Georgia nonprofit corporation whose income is exempt from federal income tax pursuant to Section 115 of the Internal Revenue Code of 1986 and held exclusively for the benefit of a county municipality or school district shall be considered to be public property within the meaning of this paragraph. Today georgia nonprofits owning property and earning revenue through rentals or other income producing activities can relax for a moment. 3 Acquisition of the property exceeds mere latent ownership.

The mailing address for Form 3605 is Georgia Department of Revenue 1800 Century Center Blvd. Nonprofit private schools any combination of grades 1-12. It is the responsibility of the owner to inform the board of tax assessors if the use of the property has changed.

1A Public property 1D Property held by a Georgia nonprofit corporation whose income is exempt from federal income tax and held exclusively for the benefit of a county municipality or school district 2 All places of burial 2A All places of. Georgia Department of Revenue 7 Exempt Properties Workshop 62017 48-5-721. However due to a 2009 Court decision regarding GCN member Nuçis Space in Athens Georgia changes to the definition of organizations of purely public charity could have had drastic effects on many.

The georgia code grants several exemptions from property tax. 2 The property is held in good faith for exempt use. To be exempt from Georgia state sales and use tax a nonprofit must fit into a specific exemption category.

Property Tax Homestead Exemptions. In order to qualify for one of the exemptions the property must not be used for the purpose of producing private or corporate profit and any income from. Exist among the various states in their granting of property tax exemptions to certain types of non-profit organizations.

The Athens-Clarke County Board of Tax Assessors de-nied the exemption and the foundation appealed to the Board of Equalization which reversed and held that the foundation is entitled to the. Georgia exempts a property owner. A nonprofit tax-exempt child-caring institution group home child-placing institution adoption agency or maternity home licensed by the Georgia Department of Human Resources DHR is exempt in the purchase of tangible personal property and services.

Co-located data centers and single-user data centers that invest 100 million to 250 million in a new facility may qualify for a full sales and use tax exemption on eligible expenses which. And 4 Acquisition of the property must be reasonable and proporionate to the future needs of the tax-exempt entity. Disabled Veteran or Surviving Spouse Any qualifying disabled veteran may be granted an exemption of 60000 plus an additional sum from paying property taxes for county municipal and school purposes.

Nonprofit organizations rely on property and sales tax exemptions to provide vital services to their clients many of whom are those most in need. 1 The property is committed to exempt use. This exemption may not exceed 10000 of the homesteads assessed valueOCGA.

The georgia code grants several exemptions from property tax. New signed into law May 2018. The following list sets forth the property tax exemptions that are most likely to be used by georgia nonprofit organizations.

Georgia Property Tax Exemptions for Nonprofits Amendment 15 1980 The Georgia Property Tax Exemptions for Nonprofits Amendment also known as Amendment 15 was on the ballot in Georgia on November 4 1980 as a legislatively referred constitutional amendment. Your nonprofit in Georgia will have to pay taxes on all tangible personal property purchased. Georgia offers two possible ways for data centers to qualify for sales and use tax exemptions on qualifying purchases.

Usually there is no GA sales tax exemption to churches religious charitable civic and other nonprofit organizations. Georgia does provide limited exemptions from the payment of Georgia sales and use tax for qualifying nonprofit organizations including. Georgia has seen a flurry of activity recently around the issue of whether a non-profit must actually put its property to exemptcharitable use to qualify.

Se unit 1001 atlanta ga 30316 Usually there is no ga sales tax exemption to churches religious charitable civic and other nonprofit. Referendum 1 which was approved by voters in 2014 extended a public property ad valorem tax exemption. Licensed nonprofit orphanages adoption agencies and maternity homes.

Who is eligible for sales tax exemption in Georgia. Property will qualify for exemption from property tax so long as. County Property Tax Facts.

No longer required for tax years beginning on or after 112008 Forms 990 and 5500 should be mailed to Georgia Department of Revenue PO. Taxpayer has burden of proving it qualifies for an exemption Much more than saying we qualify 24 Purely Public Charities Qualification Requirements 1 Owner must qualify as a purely public charity under Georgia law. The foundation applied for an exemption from property tax as an institution of purely public charity under OCGA.

Box 740395 Atlanta GA 30374-0395. Unlike some states Georgia does not provide a general exemption from the payment of state sales and use tax for nonprofit organizations. 48-5-52 Floating Inflation-Proof Exemption.

Licensed nonprofit in-patient general hospitals mental hospitals nursing homes and hospices. Property tax exemption measures in Georgia. Property Tax Millage Rates.

Property tax exemption briefing for nonprofits this briefing for nonprofits provides an overview of the nuçi case and provides a framework for moving forward on the issue of property tax exemption. We are a Homeowners Association. NE Suite 15311 Atlanta GA 30345-3205.

Are there any exceptions for GA sales tax exemption.

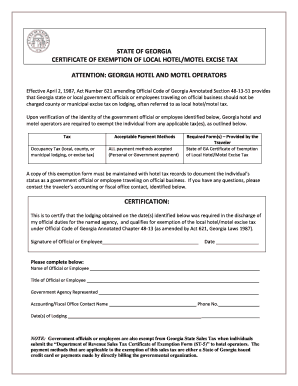

Ga Certificate Of Exemption Of Local Hotel Motel Excise Tax 2013 2022 Fill Out Tax Template Online Us Legal Forms

Requirements For Tax Exemption Tax Exempt Organizations

Fillable Online Sao Georgia Hotel Tax Exempt Form Fax Email Print Pdffiller

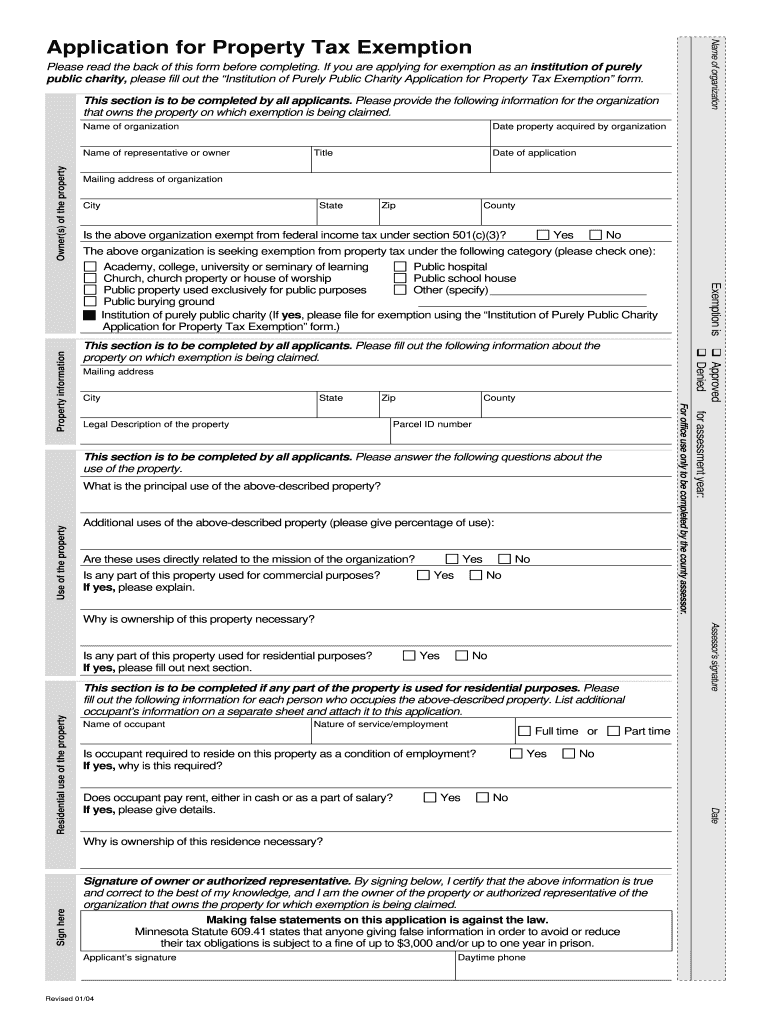

Mn Application For Property Tax Exemption Carver County 2004 2022 Fill Out Tax Template Online Us Legal Forms

10 Ways To Be Tax Exempt Howstuffworks

Difference Between Nonprofit And Tax Exempt Mission Counsel

Advisory Committee On Tax Exempt And Government Entities Act

How To Get A Sales Tax Exemption Certificate In Ohio Startingyourbusiness Com

How To Get A Sales Tax Exemption Certificate In Utah

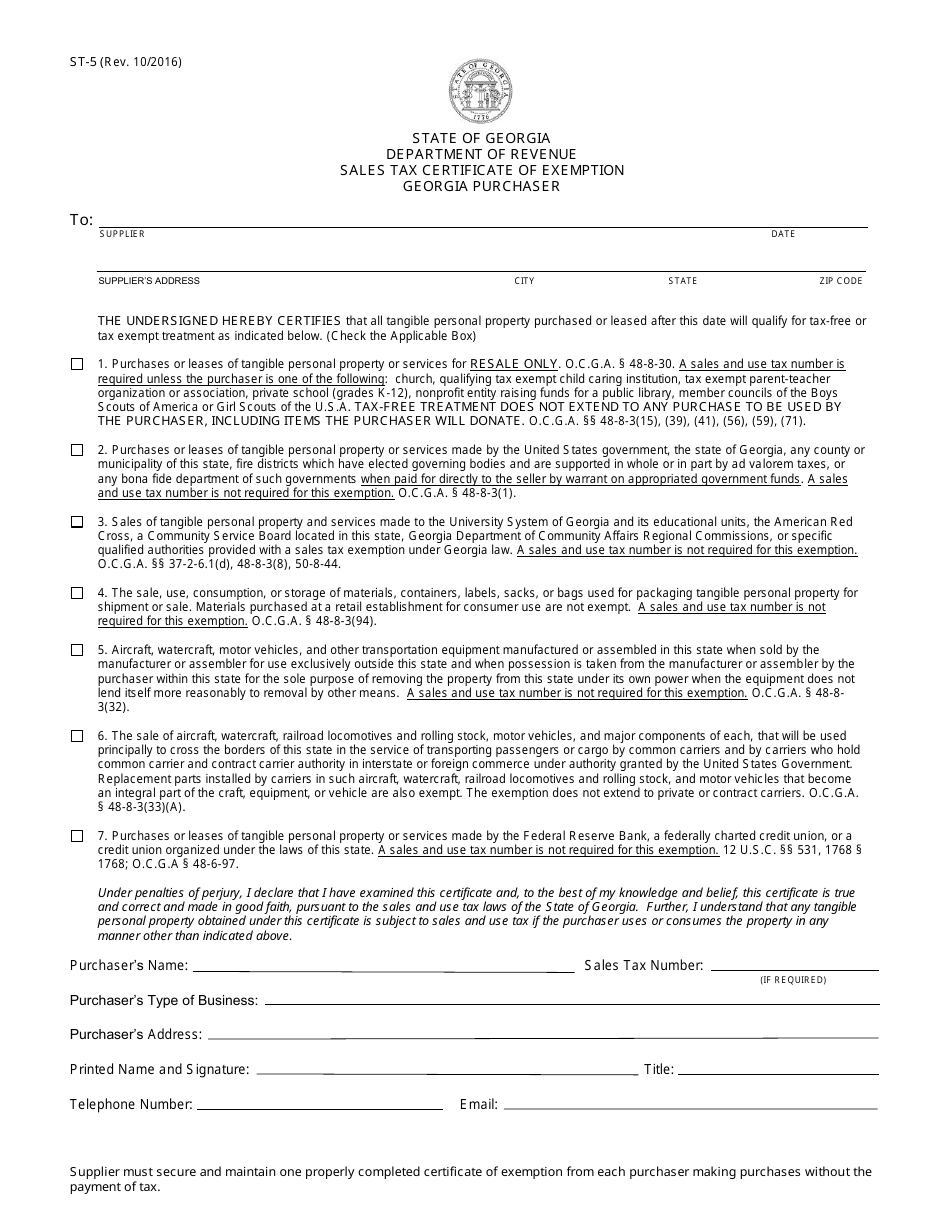

Form St 5 Download Fillable Pdf Or Fill Online Sales Tax Certificate Of Exemption Georgia Purchaser Georgia United States Templateroller

Top Corporate Credit Card Policy Template Corporate Credit Card Policy Template Policies

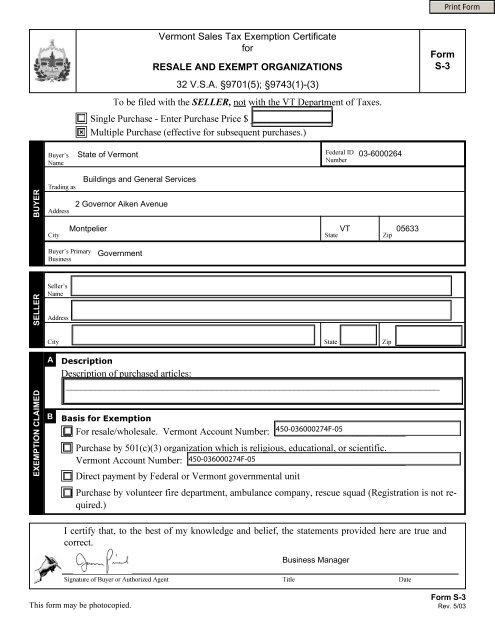

Vermont Sales Tax Exemption Certificate For Form S

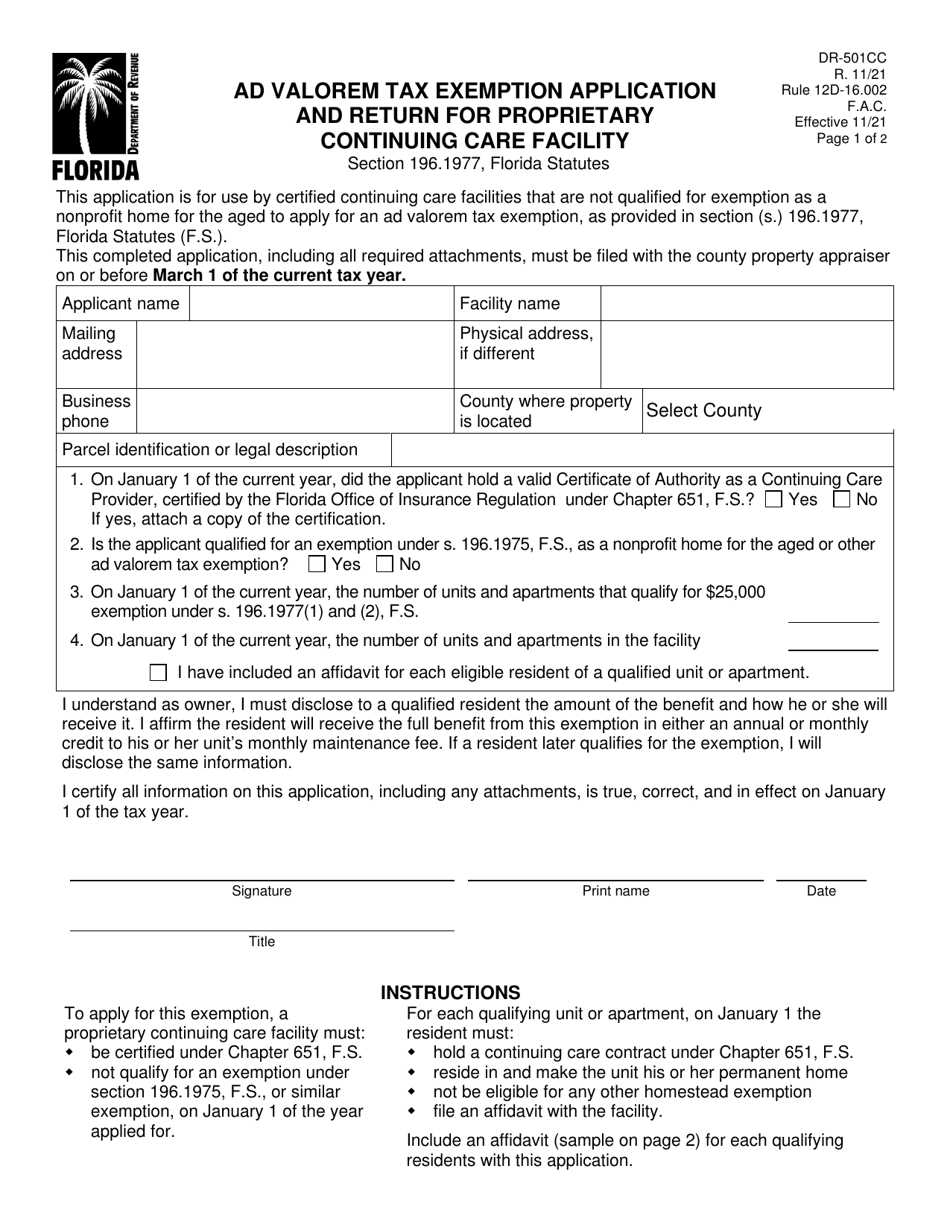

Form Dr 501cc Download Fillable Pdf Or Fill Online Ad Valorem Tax Exemption Application And Return For Proprietary Continuing Care Facility Florida Templateroller

What Is A Homestead Exemption California Property Taxes

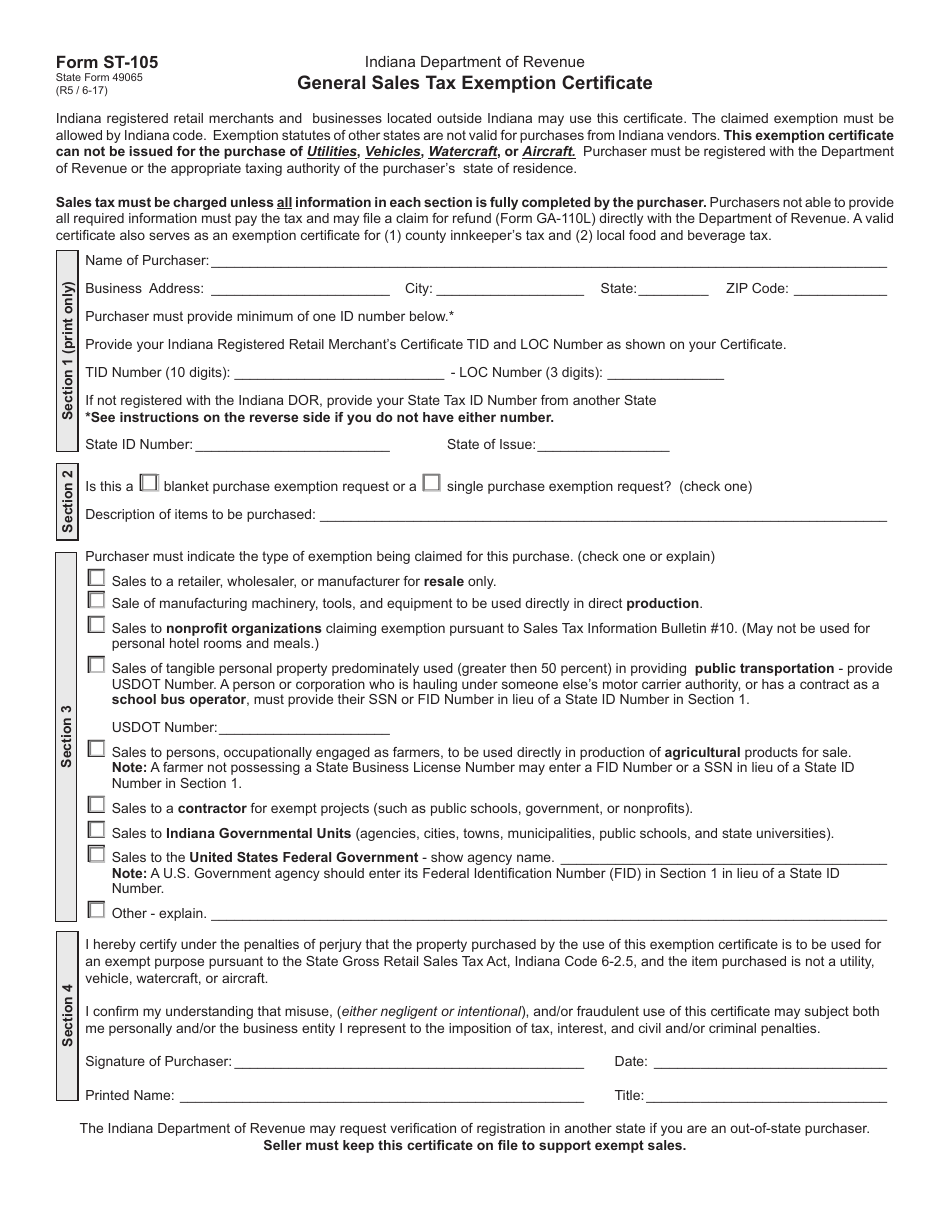

State Form 49065 St 105 Download Fillable Pdf Or Fill Online General Sales Tax Exemption Certificate Indiana Templateroller